Apply Bank Online: A Comprehensive Guide for Hassle-Free Banking

Source www.financestrategists.com

Greetings, readers!

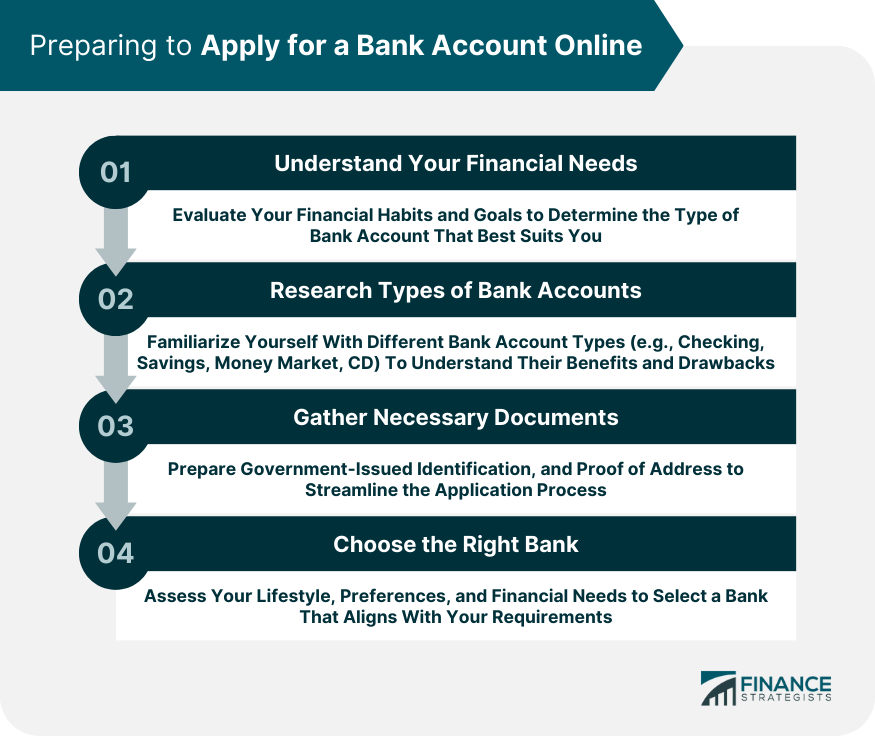

In the fast-paced world we live in, convenience is key. That’s why online banking has become increasingly popular, allowing you to manage your finances from the comfort of your own home. If you’re looking to open a bank account or apply for a loan online, read on for a comprehensive guide that will make the process a breeze.

Step 1: Choose the Right Bank

The first step in applying for a bank account online is choosing the right bank. Consider factors like fees, interest rates, and online banking capabilities. Research different banks online or consult with a financial advisor to find the best option for your needs.

Step 2: Gather Required Documents

Before you can apply bank online, you’ll need to gather certain documents, such as:

- Government-issued ID: Passport, driver’s license, or national ID card

- Proof of address: Utility bill, rental agreement, or mortgage statement

- Income verification: Pay stubs, tax returns, or bank statements

- Other documents: Depending on the bank and account type, you may also need to provide additional documents, such as a business license or employment verification letter.

Step 3: Fill Out the Online Application

Once you’ve chosen a bank and gathered your documents, you can start filling out the online application. Be sure to provide accurate information and double-check your entries before submitting. Most applications have multiple pages, so take your time and ensure you enter all required details.

Step 4: Submit Your Application

After completing the online application, review it carefully one last time and click the submit button. The bank will process your application and let you know if you’ve been approved. Approval times vary from bank to bank, but you can expect a response within a few days or weeks.

Step 5: Fund Your Account

Once your account is approved, you can fund it by transferring money from another account or setting up a direct deposit from your employer. You can usually fund your account online through the bank’s website or mobile app.

Step 6: Use Your New Bank Account

After your account is funded, you can start using it to make purchases, pay bills, and manage your finances online. Be sure to set up online banking and mobile banking for convenient account access from anywhere.

Step 7: Monitor Your Account Regularly

It’s essential to monitor your bank account regularly to ensure there are no unauthorized transactions or errors. You can set up alerts to notify you of any suspicious activity or low balances. By staying on top of your finances, you can avoid fraud and maintain control over your money.

Online Banking Features

Applying bank online offers numerous advantages, including:

- Convenience: Apply for a bank account from anywhere with an internet connection.

- Time-saving: Avoid the hassle of visiting a physical bank branch.

- Wide selection: Choose from various banks and account types without leaving your home.

- Transparency: Access detailed information about your account and transactions online.

- Control: Manage your finances and make informed decisions from the palm of your hand.

Table: Comparison of Online Savings Accounts

| Bank | Interest Rate | Minimum Balance | Monthly Fee |

|---|---|---|---|

| Ally Bank | 3.30% APY | $0 | $0 |

| Capital One 360 | 3.25% APY | $0 | $0 |

| Discover Bank | 3.00% APY | $0 | $0 |

| CIT Bank | 3.00% APY | $100 | $0 |

| Marcus by Goldman Sachs | 2.75% APY | $0 | $0 |

Conclusion

Applying bank online is a convenient, time-saving, and secure way to manage your finances. By following the steps outlined in this guide, you can easily open a bank account, apply for a loan, or access your existing accounts online. Remember to research different banks, gather necessary documents, and monitor your account regularly to ensure a smooth and hassle-free banking experience.

For more information on banking and personal finance, be sure to check out our other articles:

- [How to Budget Your Money Effectively](link to article)

- [Investing 101: A Beginner’s Guide to Growing Your Wealth](link to article)

- [Understanding Credit Scores and How to Improve Yours](link to article)

FAQ about Apply Bank Online

How do I apply for a bank account online?

Most banks have an online application process. Visit the bank’s website, navigate to the "Open an Account" or "Apply Now" section, and follow the instructions.

What documents do I need to apply for a bank account online?

Typically, you’ll need a valid government-issued ID, proof of address, and Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN).

How long does the online application process take?

It usually takes around 15-30 minutes to complete. Some banks may require additional steps like verifying your identity or funding the account.

Is it safe to apply for a bank account online?

Yes, reputable banks use secure encryption technology to protect your personal information.

What happens after I submit my application?

The bank will review your application and may contact you for additional information. Once approved, you’ll receive account details and instructions on how to activate your account.

Can I open multiple bank accounts online?

Yes, you can often open multiple accounts with different banks or under different product types (e.g., checking, savings, money market).

Are there any fees for applying for a bank account online?

It depends on the bank. Some banks may charge an application fee, while others offer fee-free options.

Can I get a debit or credit card with my online bank account?

Yes, many banks offer debit and credit cards as part of their online account services.

What if I’m not approved for a bank account online?

Contact the bank to inquire about the reason for denial. You may need to provide additional documentation or meet additional criteria.

Can I apply for a loan or mortgage online?

Yes, some banks allow you to apply for loans and mortgages through their online platforms. However, the requirements and approval process may vary depending on the type of loan or mortgage.